i know in pervious post i said that the eurjpy could go to the sky and beyound will some of it is true and the trade is working out fine. Howevr i found what i believe to be a bearish butterfly on the daily. so use caution.

News below

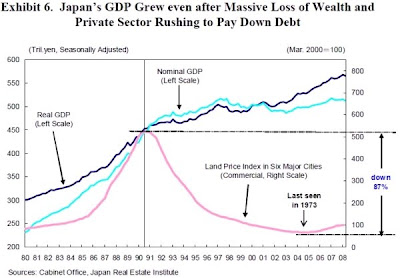

Is Japan Headed for a Financial Meltdown

Japans debt to GDP ratio is the worst in the developed world, yet the BoJs interest rates are the lowest available, excluding Switzerland.

The main reason is that for the close to 15 years weve seen an excess of Japanese savings and a deficit of demand for those savings. So the Japanese government was able to issue debt without any competition from the private sector. But the Japanese demographic profile means that more workers are withdrawing from the workplace and drawing down their retirement savings.

The Japanese government is running a fiscal deficit of 10 to 11 per cent of GDP. Expenses for social security accounts for 27 trillion against total revenues of approximately 45 trillion. In addition, the Japanese government has interest expense of 10 trillion. Add them both together, and the Japanese government is spending 90 per cent of its total revenue on these two items.

We think that we are in the midst of an inflexion point, where theres not enough Japanese savings to finance Japanese government debt. That means that the Japanese government will have to borrow in international capital markets. Given Japans risk profile its debt to GDP ratio is 230 per cent Japan may have to pay, say, 3 to 3.5 per cent to borrow. But that would push Japans interest expense to 30-35 trillion. We believe that is a recipe for disaster. The Bank of Japan has announced that it will start buying a lot of Japanese government debt, which will temporarily allay the problem. But if the market starts thinking that Japanese inflation will pick up, interest rates will be pushed higher.

One important item that has provided stability in Japan and peace of mind for investors in Japanese bonds has been Japan’s consistent current account surplus. However beginning before, but accelerating after the accident at Fukushima, Japan has seen its trade balance decline sharply. The reactor meltdowns and subsequent closure of the vast majority of nuclear plants has forced Japan to aggressively shift away from nuclear base load power. But that has meant it has had to pay a lot for LNG, oil and coal for its power generators.But this shift can and will be addressed and changed. This is only a temporary adjustment, large and important but temporary.

Last year, Japans had a trade deficit for the first time since 1980. New data just released shows that Japan also ran the largest single month full current account deficit since the oil shocks of the 1970′s.

Will a Japanese crisis happen there are some clear warning signs. If so it will happen sooner rather than later. No one ever thought we would see what we are witnessing in the EU, and even when all the signs were present politicians, lawmakers, economists and analysts turned a blind eye.

Originally posted here

No comments:

Post a Comment