You have to learn the rules of the game. And then you have to play better, adapt better, manage better and be more skillful than anyone else. Please read Disclaimer at the bottom of page

Economic Calendar

Live Economic Calendar Powered by the Forex Trading Portal Forexpros.com

Currency Strenght

Thursday 29 March 2012

EURCAD Cross Road

EURCAD

Will be tracking this pair to see if we can find an opportunity to roll with the winners of this battle

New updates will follow

Will be tracking this pair to see if we can find an opportunity to roll with the winners of this battle

New updates will follow

Tuesday 27 March 2012

Although we are in a strong down trend, i think the selling has slowed as volume has decresed if we start to move out of the falling trend line and price holds above the 8DMA then a push to the trigger line is on the cards, However, still very early and permature.

On the other hand i'm thinking may be a short setup may be better as Price is below the 55DMA blue line and resistance is @ 0.90798 a failed rally there and below then we should continue the down slide towards 0.89195

Usdchf update

Took awhile but it made it

Now waite for pullback

On the other hand i'm thinking may be a short setup may be better as Price is below the 55DMA blue line and resistance is @ 0.90798 a failed rally there and below then we should continue the down slide towards 0.89195

Usdchf update

Took awhile but it made it

Now waite for pullback

Friday 16 March 2012

CADJPY

4hr Cadjpy

A higher than expected reading should be taken as positive/bullish for the CAD, while a lower than expected reading should be taken as negative/bearish for the CAD.

and

A higher than expected reading should be taken as positive/bullish for the CAD, while a lower than expected reading should be taken as negative/bearish for the CAD.

unemployement

this was on the 9/03/2012 http://watch.bnn.ca/#clip634753

Followed by 16/03/2012 http://watch.bnn.ca/#clip639347

on the up side on

I guess some people are living Good Buying New cars and all that, which probably due to the stats below

On the 2nd march 2012

Canadian real GDP rose 0.4% in the fourth quarter after advancing .0% in the third quarter. Consumer spending and exports contributed the most to fourth quarter GDP Growth

Consumer price index rose on the 20th January 2012 to 2.3% in 12 months to December , following a 2.9 increase in November 2011.

Technically you can see for your self that we could be topping out in an overbrought to neutral situation. However, for now the Bulls should Waite for a pull back and bears might wanna scalp down.

Me personally i'm short only because with the current news today the cad didn't' qualify it to break out and continue on its bull run. Low volume falling stochastic and with a break of my trigger line and possible end of a 5th wave up i think we should be headed down. in the short term however it is Still early so we have to Waite and see.

Originally i thought with a weakening Jap economy(May Be) I thought the CAD would be able to break out on such pass strong Performance of late . However my view has changed because the Cad was unable to produces any good data today with

Manufacturing coming at

| |||||||||||||||||

|

A higher than expected reading should be taken as positive/bullish for the CAD, while a lower than expected reading should be taken as negative/bearish for the CAD.

and

| |||||||||||||||||

|

A higher than expected reading should be taken as positive/bullish for the CAD, while a lower than expected reading should be taken as negative/bearish for the CAD.

|

unemployement

this was on the 9/03/2012 http://watch.bnn.ca/#clip634753

Followed by 16/03/2012 http://watch.bnn.ca/#clip639347

on the up side on

| |||||||||||||||||

|

I guess some people are living Good Buying New cars and all that, which probably due to the stats below

On the 2nd march 2012

Canadian real GDP rose 0.4% in the fourth quarter after advancing .0% in the third quarter. Consumer spending and exports contributed the most to fourth quarter GDP Growth

Consumer price index rose on the 20th January 2012 to 2.3% in 12 months to December , following a 2.9 increase in November 2011.

Technically you can see for your self that we could be topping out in an overbrought to neutral situation. However, for now the Bulls should Waite for a pull back and bears might wanna scalp down.

Me personally i'm short only because with the current news today the cad didn't' qualify it to break out and continue on its bull run. Low volume falling stochastic and with a break of my trigger line and possible end of a 5th wave up i think we should be headed down. in the short term however it is Still early so we have to Waite and see.

Tuesday 13 March 2012

Is there a shift taking place ?

The U.S. dollar is becoming more and more attractive. With QE3

being shelved

Over the past few months the U.S. dollar traded primarily on

risk appetite. I believe they would sell the dollar and by risker assest. So as

the S&P 500 or the dow rose the dolla would sell off. However, i believe

something has fundamentally changed. The us dollar has started to take notice

of the improvements in the us economy by rising on good data and sliding on

weakness. Today the reaction and Optimism from the FOMC sent the dollar

soaring, against all major currency. Now tell me if I’m wrong in thinking

whether or not we are seeing a fundamental shift in how the dollar is trading

Japan

Shirakawa said “The task of overcoming deflation and

achieving sustainable economic growth with price stability cannot be realized

overnight. The issue of beating deflation is strongly related to how growth

potential should be strengthened and patient effort is needed to tackle this

problem. The BOJ will continue to do the best we can as a central bank. At the

same time, I strongly expect that parties concerned such as companies,

financial institutions and the government will do their utmost while fully

recognizing the importance of strengthening growth potential. In managing

policy, we must ensure that the economy is headed toward a path of sustainable

growth and price stability. Given that the cause of deflation is structural

problems such as Japan's low growth potential, we cannot expect to achieve our

goal immediately." So has the Jap tactics changed also is forcing on

growth and will this allow for a weaker yen? Instead of relying on intervention

which has proven woefully ineffective in weakening the yen, the Japanese

monetary authorities are looking at QE as a much viable policy tool to control

any appreciation of the currency.” And if this is the case then the yen will

weaken as proved with other countries that has introduced this method so in

effect The central bank’s plans for

continued easy monetary policy has made the Yen less attractive especially on a

day when the FOMC statement suggests that more QE in U.S. is no longer

necessary.

Pls tell me what you think

Monday 12 March 2012

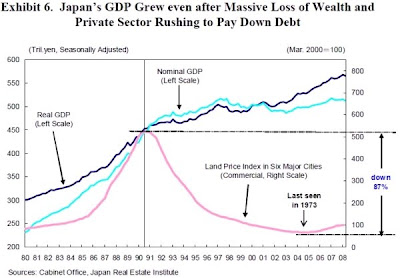

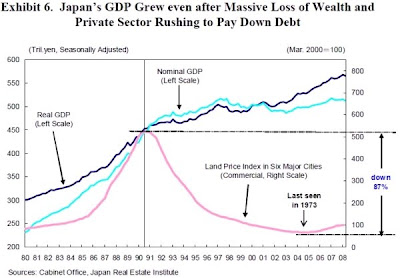

is Japan headed for a Financial Meltdown

FXEmpire | March 12 2012 12:29 EDT

i know in pervious post i said that the eurjpy could go to the sky and beyound will some of it is true and the trade is working out fine. Howevr i found what i believe to be a bearish butterfly on the daily. so use caution.

News below

By FX Empire.com

Over the past few weeks, most economists and investors have been watching the story in Greece unfold. Waiting at the back door are Hungary, Portugal, Spain and Italy. The EU has spent a lot of time and effort pushing austerity measures and using standardized calculations to evaluate budgets and financial projections, in many cases ignoring cultural and financial differences. EU ministers have tied debt to GDP, which is a text book approach. Except it doesnt always work and sometimes it just is plain old fashion wrong. Lets take a look at our close ally and friends, but a country no one can really figure out.

Japans debt to GDP ratio is the worst in the developed world, yet the BoJs interest rates are the lowest available, excluding Switzerland.

The main reason is that for the close to 15 years weve seen an excess of Japanese savings and a deficit of demand for those savings. So the Japanese government was able to issue debt without any competition from the private sector. But the Japanese demographic profile means that more workers are withdrawing from the workplace and drawing down their retirement savings.

The Japanese government is running a fiscal deficit of 10 to 11 per cent of GDP. Expenses for social security accounts for 27 trillion against total revenues of approximately 45 trillion. In addition, the Japanese government has interest expense of 10 trillion. Add them both together, and the Japanese government is spending 90 per cent of its total revenue on these two items.

We think that we are in the midst of an inflexion point, where theres not enough Japanese savings to finance Japanese government debt. That means that the Japanese government will have to borrow in international capital markets. Given Japans risk profile its debt to GDP ratio is 230 per cent Japan may have to pay, say, 3 to 3.5 per cent to borrow. But that would push Japans interest expense to 30-35 trillion. We believe that is a recipe for disaster. The Bank of Japan has announced that it will start buying a lot of Japanese government debt, which will temporarily allay the problem. But if the market starts thinking that Japanese inflation will pick up, interest rates will be pushed higher.

One important item that has provided stability in Japan and peace of mind for investors in Japanese bonds has been Japan’s consistent current account surplus. However beginning before, but accelerating after the accident at Fukushima, Japan has seen its trade balance decline sharply. The reactor meltdowns and subsequent closure of the vast majority of nuclear plants has forced Japan to aggressively shift away from nuclear base load power. But that has meant it has had to pay a lot for LNG, oil and coal for its power generators.But this shift can and will be addressed and changed. This is only a temporary adjustment, large and important but temporary.

Last year, Japans had a trade deficit for the first time since 1980. New data just released shows that Japan also ran the largest single month full current account deficit since the oil shocks of the 1970′s.

Will a Japanese crisis happen there are some clear warning signs. If so it will happen sooner rather than later. No one ever thought we would see what we are witnessing in the EU, and even when all the signs were present politicians, lawmakers, economists and analysts turned a blind eye.

Originally posted here

i know in pervious post i said that the eurjpy could go to the sky and beyound will some of it is true and the trade is working out fine. Howevr i found what i believe to be a bearish butterfly on the daily. so use caution.

News below

Is Japan Headed for a Financial Meltdown

Japans debt to GDP ratio is the worst in the developed world, yet the BoJs interest rates are the lowest available, excluding Switzerland.

The main reason is that for the close to 15 years weve seen an excess of Japanese savings and a deficit of demand for those savings. So the Japanese government was able to issue debt without any competition from the private sector. But the Japanese demographic profile means that more workers are withdrawing from the workplace and drawing down their retirement savings.

The Japanese government is running a fiscal deficit of 10 to 11 per cent of GDP. Expenses for social security accounts for 27 trillion against total revenues of approximately 45 trillion. In addition, the Japanese government has interest expense of 10 trillion. Add them both together, and the Japanese government is spending 90 per cent of its total revenue on these two items.

We think that we are in the midst of an inflexion point, where theres not enough Japanese savings to finance Japanese government debt. That means that the Japanese government will have to borrow in international capital markets. Given Japans risk profile its debt to GDP ratio is 230 per cent Japan may have to pay, say, 3 to 3.5 per cent to borrow. But that would push Japans interest expense to 30-35 trillion. We believe that is a recipe for disaster. The Bank of Japan has announced that it will start buying a lot of Japanese government debt, which will temporarily allay the problem. But if the market starts thinking that Japanese inflation will pick up, interest rates will be pushed higher.

One important item that has provided stability in Japan and peace of mind for investors in Japanese bonds has been Japan’s consistent current account surplus. However beginning before, but accelerating after the accident at Fukushima, Japan has seen its trade balance decline sharply. The reactor meltdowns and subsequent closure of the vast majority of nuclear plants has forced Japan to aggressively shift away from nuclear base load power. But that has meant it has had to pay a lot for LNG, oil and coal for its power generators.But this shift can and will be addressed and changed. This is only a temporary adjustment, large and important but temporary.

Last year, Japans had a trade deficit for the first time since 1980. New data just released shows that Japan also ran the largest single month full current account deficit since the oil shocks of the 1970′s.

Will a Japanese crisis happen there are some clear warning signs. If so it will happen sooner rather than later. No one ever thought we would see what we are witnessing in the EU, and even when all the signs were present politicians, lawmakers, economists and analysts turned a blind eye.

Originally posted here

CHINA UNCERTAINTY

Data on Friday showing solid growth in U.S. employment suggested the world's largest economy was strengthening and in less need of further monetary stimulus from the Fed, which holds its policy meeting on Tuesday.

Economic conditions elsewhere were less rosy or clear-cut.

China's trade balance data over the weekend showed the largest deficit in at least a decade, following recent reports that inflation cooled in February while retail sales and industrial output fell below forecast.

"Aside from healthy demand for industrial metals, assessment of recent Chinese data is mixed, and more figures are needed to clarify the uncertainty," Niimura said.

Mr PRICe ABOVE 50% ABC WKLY PIVIOT POINTS @ 107.80

Data on Friday showing solid growth in U.S. employment suggested the world's largest economy was strengthening and in less need of further monetary stimulus from the Fed, which holds its policy meeting on Tuesday.

Economic conditions elsewhere were less rosy or clear-cut.

China's trade balance data over the weekend showed the largest deficit in at least a decade, following recent reports that inflation cooled in February while retail sales and industrial output fell below forecast.

"Aside from healthy demand for industrial metals, assessment of recent Chinese data is mixed, and more figures are needed to clarify the uncertainty," Niimura said.

Mr PRICe ABOVE 50% ABC WKLY PIVIOT POINTS @ 107.80

Sunday 11 March 2012

British Pound Outlook Monthly/Weekly Charts

Clues: The Asending triangle formation of the Pound technically is a bullish Sign. However with a few bolts that need to be nailed into the euro, we should antispate a break to the the down side.

GBPUSD MONTHLY

A break above the 1.6800 level which is a 50% retracement of the of the 2008 finanical crisis meltdown

could see a test of the Upper retrracement level of 61.8% just above 1.7500 the double top at 1.6800 will play a hugh role in any upside momentum in the the pound.

On the weekly chart, the Pound found support just above 1.5300 level which looks like an uneven head and shoulders formation. This a bearish indication, and a break of the supporting levels

will support an out look for a stronger dollar.

If we fail @ the support 1.5300 expect futher range trading at a rise back to the lower mids of 1.6180, the latter being the top of the ead and shoulders .

GBPUSD WKLY

In conclusion with the bank of Engalnd supporting further QE (Quantitative easing and the International Montery Fund revising uk growth to 1.1% from 1.6%, we find it difficult to see much Upside if any

Importantly, a sovergin downgrade of the uk could be the tipping point that sends the sterling Lower.

Daily Chart

4hr Chart

Your Welcome

All i ever wanted was for someone to tell me the Truth

All i ever wanted was for someone to tell me the Truth. Then i can decided what i will do with the information, be it Call, Stick, Fold or Bust.

Emmmm, Whats really going on Europe has nothing to do with solving a debt crisis and everything to do with preserving a corrupt system based on limitless debt and growing government power. The sooner you understand that fact, the sooner you’ll be able to prepare for what happens next. There are two options for what happens next, and we’ll get to those shortly.

First, though, doesn’t it strike you as strange that all of Europe can be brought to its knees by tiny little Greece? Greek GDP is just 2.4% of Europe’s GDP. In economic terms, Greece doesn’t matter. Its lack of growth or economic competitiveness shouldn’t be factors that can destroy Europe’s 13-year single currency experiment. Yet, Greece obviously does matter; otherwise the European financial markets wouldn’t be celebrating the latest €130 billion bailout that’s on its way to Athens.

So here’s our question: Why do Greek finances matter to anyone outside of Greece? If you rule out the obvious things that don’t matter, that leaves everything else. Or as Sherlock Holmes was fond of saying, “when you have eliminated the impossible, whatever remains, however improbable, must be the truth.”

First, let’s see why the possible explanations for Greece’s importance to the world are actually impossible. Take the issue of debt reduction. As we wrote last week, the deal before Europe would reduce Greek debt to 120% of GDP by 2020. The IMF says that level is sustainable.

Back in a universe where common sense prevails, you can see that the plan is a joke, at least in terms of debt reduction. A plan to reduce Greek’s debt to 120% of GDP...EIGHT YEARS FROM NOW...is not a serious plan about debt. Therefore, the plan cannot be about debt reduction.

Will the plan make Greece more competitive in the long run? Well, probably not. In order to get more money by March 20th, the Greek Parliament had to agree to certain structural reforms. Some of those reforms might even be a good idea. But cutting the minimum wage isn’t going to be popular. And with Greek GDP shrinking by 7% in the fourth quarter, years of austerity won’t make Greece more competitive. The lifestyle of the Greeks will be destroyed and the debt will remain. Therefore, the plan cannot be about making Greece more competitive.

Does saving Greece save the euro? Not at all. The euro would be better off without Greece and Greece would be better off without the euro. The Germans are even planning for a euro that doesn’t include Greece. With its own currency, Greece could default, devalue, inflate and start over. Argentina did it in the last 10 years. It’s not rocket science. Therefore, saving Greece is not about saving the euro.

If saving Greece is not about saving the euro, and if it’s not about reducing Greek debt, and if it’s not about making Greece a more competitive economy...then just what IS it about? Well, now that we’ve rule out what’s impossible, let’s look at what’s left.

Saving Greece means preventing a technical default...even though Greece has already defaulted in a real-world sense. So why is avoiding a technical default so important to the European Central Bank (ECB) and the International Monetary Fund (IMF)? The current plan certainly looks like a default. Under the plan, €100 billion worth of Greek debt would disappear, thanks to a debt swap agreement with private sector investors. The ECB has twisted enough arms to get creditors to accept a 70% haircut on their current Greek debt without actually calling it a default.

And yet, bizarrely, Greece’s creditors could be forced to accept this not-a-default default losses recourse to the credit default insurance they purchased. That’s right; they might lose 70% of their capital and still be denied a payout on the default insurance they purchased. That would be like an insurance company refusing to honor a fire insurance policy because only 70% of your house burned to the ground.

It gets kind of wonky here. But really, it’s about who gets to make the rules. To you and me and everyone else in the universe where common sense prevails, a non-voluntary 70% loss on your government bonds is a default. But you and I don’t get to decide what constitutes a credit default. That honour belongs to the International Swaps Derivatives Association (ISDA). The important thing to keep in mind here is that the ISDA is a trade group made up of banks and financial firms. Those are the firms that have the most to lose if Greek bonds default. It’s in the interest of the members of the ISDA that a non-voluntary credit event in Greece NOT be called a default.

It gets even murkier here. The ISDA essentially represents the global banking system. In Europe, the banking system is full of government bonds. Those bonds are nominally assets. If Greece defaults, it sets a precedent for how other countries might deal with unsustainable debt levels. This imperils the collateral of Europe’s entire banking system.

If you want to put it in simpler terms, let’s say that Europe’s banking system is full of rotting meat. Some investors bought that meat thinking they were going to get prime rib. But they can smell the stink of the meat from a mile away. They want to be compensated for the bad meat. The ISDA, which owns the freezer in which the meat went bad, says, “Well, we’ve decided the meat isn’t bad after all. And you have less of it than you thought anyway, as of now.”

This is a crude analogy. But this is exactly what happened last week. A “determinations committee” of the ISDA ruled that Greece’s default is not a default. The committee determined that “no credit event has yet occurred” for holders of credit default protection on Greece.

You can see the basic problem: everyone else knows that if Greece defaults (officially), the value of other government bonds in Spain and Italy and Portugal will plummet too. A Greek default wouldn’t be important because of the size of the default (although French and German banks would stand to lose a fair bit). It would be important because it would begin the process of blowing up bank balance sheets all over Europe.

When you realize that the ISDA and the ECB and the EU are in league to save their financial skins, you realize that the Greek rescue plans is about preventing other countries from realizing that default is an option. In fact, it’s not even about preventing the realization. It’s about making it impossible for a country to default on its obligations...even if it means erasing the word “default” from the English language.

If the centralized European Welfare State model is to survive, banks must not take losses on their government bond holdings. Individual and private investors, on the other hand, will be forced to take losses through a “collective action clause.” This clause allows your securities to be revalued without your consent if a majority of other bondholders agree to it.

Now we’re coming to the real nuts and bolts of what’s at stake. The technocrats in Europe are at war with private investors. The members of the ISDA are in league with the technocrats to preserve their system. That part is easy to understand.

The technocrats are employed by government and get to spend your money. This system is good for them. It’s good for the members of the ISDA too. Loaning money to the government is good business. Collecting rent off the expansion of credit is easy money. They want the system to last as well. Who is the system not good for? Everybody else who’s on the outside looking in. Investors who want their capital to be productive are out of luck. And taxpayers who question the value of austerity measures and debt reduction plans that don’t really reduce debt are also out of luck. No wonder they are angry.

We’ve come a long way, then. Greece isn’t about saving Greece. The only reason something so small and insignificant could matter so much is that it matters in a way no one is willing to say. It’s about the subversion of sovereignty and democratic processes by removing decisions from people and giving them to trans-national financial elites. It’s about preserving a global system that’s based on the accumulation of debt and growing government power because there are two groups of people who benefit tremendously from that system, even if most people don’t.

This is simply the latest example of corrupt government operatives colluding with the financial elite to steal money, liberty and big chunks of “the pursuit of happiness” from “we, the people.”

Regards,

by Dan Denning,

for The Daily Reckoning

for The Daily Reckoning

You heard it 1st @timelessfx

Friday 9 March 2012

•GREECE ISSUES STATEMENT ON DEBT SWAP

The biggest sovereign debt restructuring in history is now, well,

history. The headlines are finally come in:

We learn that €152 of the €177 billion in Greek law bonds have tendered, which is 85.8%. This means that €25 billion in Greek law bonds have not - these are the hedge funds that could not be Steven Rattnered into participating, and will now sue Greece for par recoveries.This is also the number that ISDA will look at today to determine if, in conjunction with the CAC, means a credit event has occurred. And yes, the CACs are coming, as is the Credit Event finding: by http://www.zerohedge.com/

- GREECE COMPLETES DEBT SWAP

- GREECE SAYS EU172 BLN OF BONDS TENDERED IN SWAP

- GREECE GETS TENDERS, CONSENTS FROM HOLDERS OF 85.8%

- GREECE SAYS 69% OF NON-GREEK LAW BONDHOLDERS PARTICIPATED

We learn that €152 of the €177 billion in Greek law bonds have tendered, which is 85.8%. This means that €25 billion in Greek law bonds have not - these are the hedge funds that could not be Steven Rattnered into participating, and will now sue Greece for par recoveries.This is also the number that ISDA will look at today to determine if, in conjunction with the CAC, means a credit event has occurred. And yes, the CACs are coming, as is the Credit Event finding: by http://www.zerohedge.com/

Wednesday 7 March 2012

AudUSd 07/03/2012

Lets start with the Daily being Correctively  Bullish ( the only thing that worries me is that the aud has failed to rally back to the Larger medium Line so this signals a drop to the base line EMMMM!!!

Bullish ( the only thing that worries me is that the aud has failed to rally back to the Larger medium Line so this signals a drop to the base line EMMMM!!!

Although this trade is still in its infantacy on the 4hr time.

I took advantage of the weekly Pivot support @ 1.05392 using the 4hr Anchor System

support @ 1.05392 using the 4hr Anchor System

We had RBA keeping intrest rates the same @4.25

RBA keeping intrest rates the same @4.25

As the drop in the audusd slowed down and the dolla index peaking today @ 73.200 I took advantage

A 4hr fractral at A wkly support level 1.05392

support level 1.05392

A True swing buy signal warning us of a possiable surge to the 8Dema. A close above the 8Dema @ 1.0572 which also happens to be montly s1 turn resistance @ 1.05821 a break above there

resistance @ 1.05821 a break above there

Will continue the reversal upwards

But not so fast we have unemployment rate and change due out later today so will have to waite and see.

So we are still correctively bullish on the daily (see rules above) untill 1.05821 montly pivot can be recaptured and held

bullish on the daily (see rules above) untill 1.05821 montly pivot can be recaptured and held

Hrly Below

You can see Yellow 4hr confirm push above 50 while the stochastics hrly dips to the up side

4hr blue line rsi rising

volume surge not great on the hrly but i did say this trade is still young will have to want and see what happens in th e market and employment figure results draws closer

P.s i have to go down to the 5 min time frame to get entry not something i ususally do but becasuse the trade is only in its potential stage i took the chance with tight

time frame to get entry not something i ususally do but becasuse the trade is only in its potential stage i took the chance with tight  stops . presently, my stop is at break even.

stops . presently, my stop is at break even.

pls comment

Bullish ( the only thing that worries me is that the aud has failed to rally back to the Larger medium Line so this signals a drop to the base line EMMMM!!!

Bullish ( the only thing that worries me is that the aud has failed to rally back to the Larger medium Line so this signals a drop to the base line EMMMM!!!Although this trade is still in its infantacy on the 4hr time.

I took advantage of the weekly Pivot

support @ 1.05392 using the 4hr Anchor System

support @ 1.05392 using the 4hr Anchor SystemWe had

RBA keeping intrest rates the same @4.25

RBA keeping intrest rates the same @4.25As the drop in the audusd slowed down and the dolla index peaking today @ 73.200 I took advantage

A 4hr fractral at A wkly

support level 1.05392

support level 1.05392 A True swing buy signal warning us of a possiable surge to the 8Dema. A close above the 8Dema @ 1.0572 which also happens to be montly s1 turn

resistance @ 1.05821 a break above there

resistance @ 1.05821 a break above thereWill continue the reversal upwards

But not so fast we have unemployment rate and change due out later today so will have to waite and see.

So we are still correctively

bullish on the daily (see rules above) untill 1.05821 montly pivot can be recaptured and held

bullish on the daily (see rules above) untill 1.05821 montly pivot can be recaptured and held

Hrly Below

You can see Yellow 4hr confirm push above 50 while the stochastics hrly dips to the up side

4hr blue line rsi rising

volume surge not great on the hrly but i did say this trade is still young will have to want and see what happens in th e market and employment figure results draws closer

P.s i have to go down to the 5 min

time frame to get entry not something i ususally do but becasuse the trade is only in its potential stage i took the chance with tight

time frame to get entry not something i ususally do but becasuse the trade is only in its potential stage i took the chance with tight  stops . presently, my stop is at break even.

stops . presently, my stop is at break even.

pls comment

Subscribe to:

Posts (Atom)