FTSE 100 Daily

The FTSE 100 index rose 0.4% to end at 6,755.45 after the index closed

slightly higher on Monday. In the banking sector, Lloyds Banking Group PLC

(LYG) rose 3% and HSBC Holdings PLC (HSBC) gained 2.4%. Royal Bank of Scotland

Group PLC (RBS) rose 1.8% and Barclays PLC (BCS) gained 1.2%.

U.K. data showed new car sales surging 11% in 2013 versus 2012, the best

year since pre-recession 2007, said the U.K. Society of Motor Manufacturers and

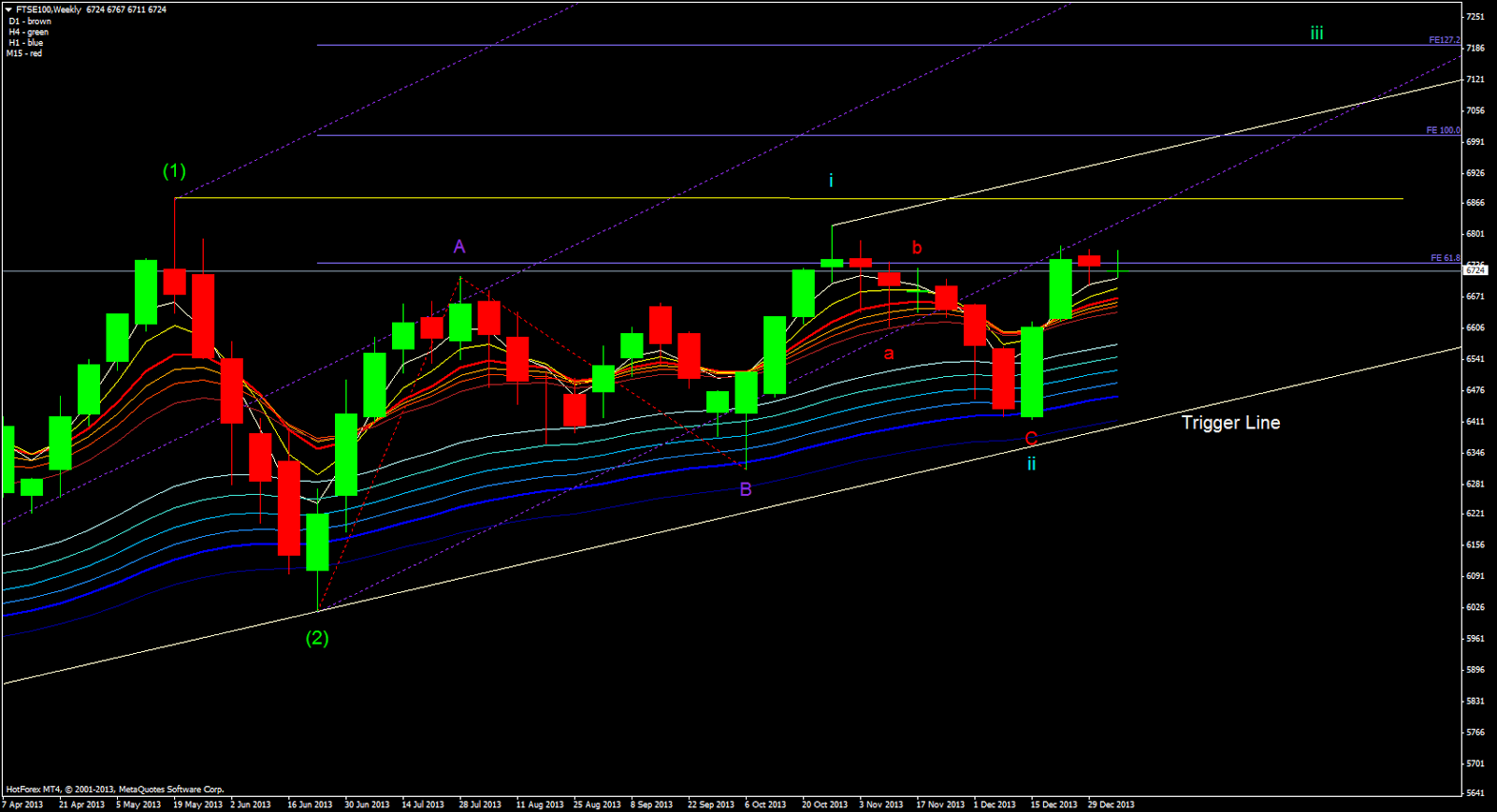

Traders. Sales for December rose 24%, the 22nd-straight monthly rise.With ABC Decline in the FTSE 100 completing II a possible break out of

the Highs is on the card for the FTSE 100 which will indicate and confirm a

rally in wave ii according to our count.

With the FTSE

maintaining the rising trend line with still positive out comes across

the Atlantic things seem to be looking good for the UK see chart and news from

Uk stocks

Britain's blue chip share index touched a one-week high on Tuesday, with

gains in financial stocks pushing the FTSE 100 towards major technical

resistance levels and overshadowing weakness in retailers.

Lloyds was the top gainer, rising 2.4 percent, as investors bought the stock on expectations the bank will start paying dividends this year, and that it will benefit from a recovering British economy and housing market. Lloyds is expected to announce a payout to shareholders on its 2013 results, with StarMine consensus pointing to a dividend yield of 0.4 percent this year, rising to 3.1 percent next year."Lloyds is a domestic story - if the property market is going to do well, then the leverage you get out of Lloyds is great, plus they are going to pay a dividend this year, so the income funds will be buying them," said ZegChoudhry, head of equities trading at Northland Capital.

Bolstering the British economic recovery story, car sales rose to their highest level since 2007 last year, data showed on Tuesday, while British businesses reported strong growth and rising confidence.

Analysts at Bernstein Research highlighted Lloyds as the top pure play on UK consumers, while noting that RBS looks promising on valuation and that HSBC is likely to increase its risk appetite in the region.RBS shares rose 1.3 percent, while HSBC - the biggest constituent in the FTSE 100 - added 1.5 percent.

The gains helped boost the overall index, which was up 31.62 points, or 0.5 percent, at 6,762.35 points by 1149 GMT, closing in on its Dec. 30 high of 6,768.44 points."Technical studies are generally constructive across the daily/weekly/monthly time frames," said Ed Blake, technical analyst at Informa Global Markets.

"Only a failure to clear 6,768.44 followed by a return through 6,699.27 would caution bulls and risk a deeper near-term corrective setback."However, for now, overall FTSE 100 gains were capped by weakness in retailers, many of whom are due to issue trading updates later this week.

Lloyds was the top gainer, rising 2.4 percent, as investors bought the stock on expectations the bank will start paying dividends this year, and that it will benefit from a recovering British economy and housing market. Lloyds is expected to announce a payout to shareholders on its 2013 results, with StarMine consensus pointing to a dividend yield of 0.4 percent this year, rising to 3.1 percent next year."Lloyds is a domestic story - if the property market is going to do well, then the leverage you get out of Lloyds is great, plus they are going to pay a dividend this year, so the income funds will be buying them," said ZegChoudhry, head of equities trading at Northland Capital.

Bolstering the British economic recovery story, car sales rose to their highest level since 2007 last year, data showed on Tuesday, while British businesses reported strong growth and rising confidence.

Analysts at Bernstein Research highlighted Lloyds as the top pure play on UK consumers, while noting that RBS looks promising on valuation and that HSBC is likely to increase its risk appetite in the region.RBS shares rose 1.3 percent, while HSBC - the biggest constituent in the FTSE 100 - added 1.5 percent.

The gains helped boost the overall index, which was up 31.62 points, or 0.5 percent, at 6,762.35 points by 1149 GMT, closing in on its Dec. 30 high of 6,768.44 points."Technical studies are generally constructive across the daily/weekly/monthly time frames," said Ed Blake, technical analyst at Informa Global Markets.

"Only a failure to clear 6,768.44 followed by a return through 6,699.27 would caution bulls and risk a deeper near-term corrective setback."However, for now, overall FTSE 100 gains were capped by weakness in retailers, many of whom are due to issue trading updates later this week.

a smaller up in 1 and pull back in 2 shows higher lows in the FTSE

and as long as the index maintains this structure we will stay

bullish. when and if Price decides to turn lower over the Guppy short

faster moving averages will being to waver crossing

back below the longer term moving averages

Support services group Ashtead gained 14p at 804p, helped by Jefferies

Group raising the price target from 880p to 900p.

Upgrades from Jefferies also underpinned progress for the broadcasters,

with BSkyB adding 4.5p at 840.5p and ITV 0.2p better at 197.9p.

Low-cost airline easyJet moved up 8p to 1,605p after reporting it

carried 4,490,538 passengers in December, 3.5% up on a year ago. IAG, which

reported that premium traffic for the month of December increased by 7.3%

compared to the previous year, rose 14.2p to 428.2p.

Lloyds outperformed in the banking sector, topping the leaderboard with

a gain of 2.4p to 82.51p, with Asia-facing HSBC up 15.8p at 675.8p and Barclays

3.45p higher at 280.95p, while Royal Bank of Scotland added 6.1p at 350.4p.

Supermarket operator Sainsbury, which provides a trading update on

Wednesday, edged up 1.1p to 368.9p, while Tesco, which produces numbers on

Thursday, eased 0.45p to 331.75p and Marks & Spencer eked out a gain of

0.8p to 441.1p.

Staying in the retail sector, fashion house Next suffered at the hands

of profit-takers, down 40p to 6,130p, although HSBC upgraded the shares to

overweight from neutral and hiked its target price to 6,880p from 5,610p.

Miners were mostly lower, with Rio Tinto losing 51p at 3,215p. Vedanta

Resources fell 13p to 876.5p and Antofagasta was 6.5p lower at 780.5p.

Severn Trent slipped 37p to 1,667p when JP Morgan Cazenove downgraded

the waste and water firm to underweight from neutral.

Royal Mail Group dropped 11p to 561p as Cantor Fitzgerald initiated

coverage on the FTSE100 newcomer with a sell recommendation and 500p target

price.

Energy industry service group AMEC eased 5p to 1,081p, despite

announcing it has been awarded a £255m renewed contract by the Kuwait Oil

Company to provide project management consultancy services.

Story provided by StockMarketWire.com

No comments:

Post a Comment